-

- Sustainability

- Our environment

As a specialist lender, the impact of our business operations (Scope 1 and 2 emissions) is relatively low in comparison to the emissions associated with the finance we provide to our customers (Scope 3 category 15), and to a lesser extent those from the wider value chain (Scope 3 categories 1-14).

Our Climate Transition Plan gives priority to areas where we can deliver tangible value to our stakeholders, acting within our areas of influence, while seeking collaboration opportunities across sector.

The Group continue to purchase electricity from renewable tariffs supported by Renewable Energy Guarantees of origin (REGO). Over 99% of electricity purchased in 2023 was from renewable tariffs.

In 2023 the Group began to implement its action plan to reduce the emissions from its corporate real estate by removing gas boilers from one of our main office locations in Chatham. This action is expected to reduce Scope 1 emissions by around 21 tonnes. The Group’s new office location in Wolverhampton, expected to open in 2024 has been designed with our net zero ambitions in mind.

As we progress with reducing emissions, we continue to mitigate our impact by purchasing carbon credits from the Voluntary Carbon Market. Credits are carefully selected from a shortlist of verified and validated projects.

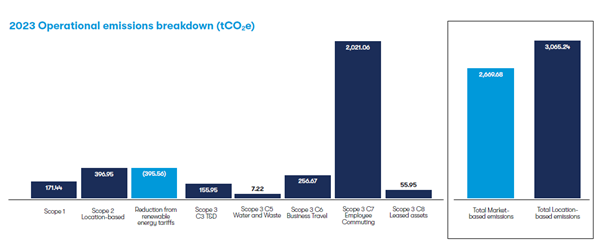

We understand that indirect emissions extend into our value chain and overtime we expect to set further targets in other relevant Scope 3 categories. See below for a breakdown of operational emissions we currently calculate and report on.

The Group continue to measure the emissions from our mortgage lending portfolio using the Partnership for Carbon Accounting Financials (PCAF) methodology.

Financed emissions remain the most material source of emissions and constitute over 97% of our total emissions inventory and is the focus of our Transition Plan.

In line with our Net-Zero Banking Alliance commitment we published our interim target for mortgage lending aiming to reducing the emissions intensity by 25% by 2030. Find out more about our Net Zero Banking Alliance Intermediate Targets.

Progress was made in 2023 closely engaging with the residential property market and the private rented sector by:

Read more about our progress in 2023 and our priorities for the future.

Below are links to our Greenhouse gas emissions Basis’ or Reporting. These documents provide explanation of the collection and treatment of data used to compile emissions reporting as part of the Annual report and accounts.

Scope 1 and 2 – Basis of reporting